Most Common Mistakes Of Homebuyers

The more you’ve bought real estate before, the more you’ll understand the intricate procedure. It’s all too easy to make the incorrect move or invest in an unsuitable investment due to the jargon and difficulties of buying a home. If you’re a first-time homebuyer, read about some of the most prevalent problems and how to prevent them to avoid buyer’s regret.

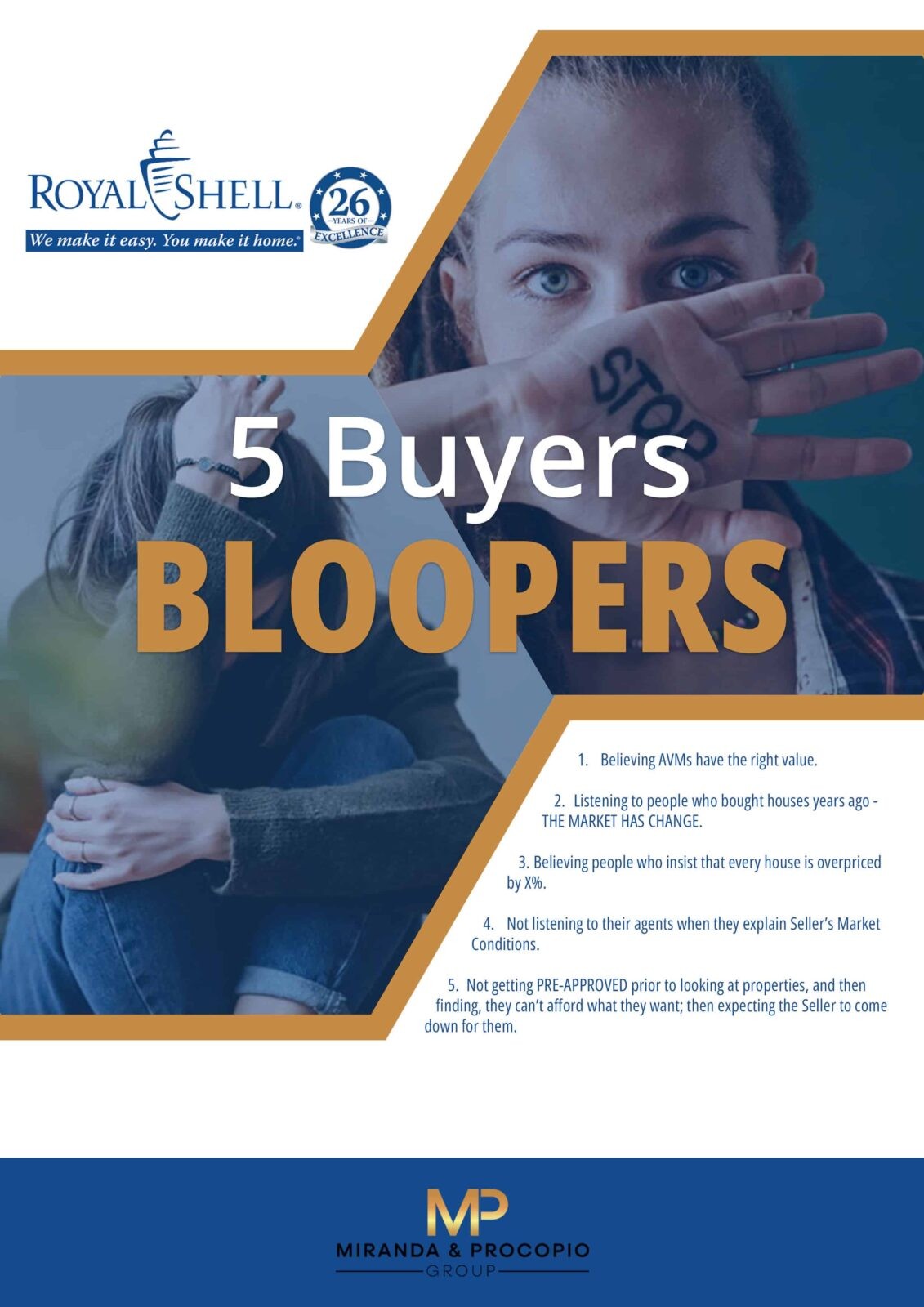

Are you a first-time homebuyer excitedly embarking on the journey of finding your dream home? While the process may seem overwhelming, we’re here to ensure you avoid the common pitfalls that many buyers encounter. In this email, we’ll highlight the “5 Buyers Bloopers” and provide valuable insights on how to sidestep them, helping you make informed decisions throughout your homebuying journey.

-

-

- Believing AVMs have the right value: Automated Valuation Models (AVMs) can be helpful, but they may not always provide an accurate assessment of a property’s value. Relying solely on AVMs can lead to buyer’s remorse. Instead, consult with a real estate professional who can provide a comprehensive comparative market analysis to determine the fair value of the property you’re interested in.

- Listening to people who bought houses years ago – THE MARKET HAS CHANGED: Real estate markets are dynamic and ever-evolving. Listening to advice from individuals who bought homes years ago may not be relevant today. Stay updated with current market trends by consulting with a knowledgeable real estate agent who has a pulse on the current conditions.

- Believing people who insist that every house is overpriced by X%: Opinions on pricing can vary greatly, and it’s essential to approach such statements with caution. While it’s crucial to be mindful of your budget, trusting the expertise of your real estate agent will help you navigate the complexities of pricing and negotiate effectively.

- Not listening to their agents when they explain Seller’s Market Conditions: In a competitive seller’s market, it’s crucial to heed your agent’s advice regarding market conditions. Ignoring their guidance may result in missed opportunities or unrealistic expectations. Rely on their expertise to strategize and secure the best deal for you.

- Not getting PRE-APPROVED prior to looking at properties: One of the most significant mistakes buyers make is neglecting to get pre-approved for a mortgage before house hunting. Pre-approval gives you a clear understanding of your purchasing power and helps you avoid falling in love with homes that are beyond your budget. Secure your pre-approval early on to streamline your search and make confident offers.

-

By avoiding these “5 Buyers Bloopers,” you’ll be well-equipped to navigate the homebuying process successfully. Our team of experienced professionals is here to guide you every step of the way, ensuring a smooth and fulfilling experience.

Don’t let these common pitfalls dampen your excitement. Contact us today to schedule a consultation and let us assist you in finding your perfect home.